prince william county real estate tax relief

Manassas Parks rate is the lowest at 3 and. The fee is calculated.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Affidavit or certification must be made between January 1 and March 1 for the.

. Real Estate Tax Exemptions are available for certain elderly and disabled persons. Prince William County Virginia Home. There are no income or net worth requirements for.

RELIEF CAN ONLY BE GRANTED ON ONE HOME OWNED AND OCCUPIED BY THE VETERAN AS THEIR PRINCIPAL PLACE OF RESIDENCE. Based On Circumstances You May Already Qualify For Tax Relief. It was established in 2000 and has since.

Real Estate Tax Relief. Prince William County Tax Administration Division 1st FL 1 County Complex Court Woodbridge VA 22192-9201. Percentage of Tax Relief.

2016 Tax Rates PDF download. Income 28001 - 45000- 50 tax relief. Based On Circumstances You May Already Qualify For Tax Relief.

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. The real estate tax rate for the. Ad See If You Qualify For IRS Fresh Start Program.

2017 Tax Rates PDF download. How is the Congestion Relief Fee Calculated. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Property Tax Prince William County. Ad See If You Qualify For IRS Fresh Start Program.

Yearly median tax in Prince William County. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida. 2015 Tax Rates PDF.

The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet. 45 of the tax due on the first 20000 of assessed value. Net combined financial worth excluding the value of the dwelling and five 5 contiguous acres of 120000.

Prince William Countys personal property tax rate of 370 per 100 in assessed value is the third lowest in Northern Virginia. The state also created instructions that Prince William County. About the Company Prince William County Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Free Case Review Begin Online. Income 0 -28000- 100 tax relief. Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue.

2019 Tax Rates PDF download. It was founded in 2000 and is a. 2018 Tax Rates PDF download.

Tax Relief for the Elderly and Disabled Contact the Real Estate. 2020 Tax Rates PDF download. If you have questions about this site please email the Real Estate.

The current fair market value of real estate situated within your city is calculated by Prince William County assessors. This legislation was done by passing a ruling to increase the Grantor Tax in the form of a Congestion Relief Fee. Free Case Review Begin Online.

Business tangible and personal property taxes were October 6th.

Voices Meals Tax In Prince William Doesn T Make Sense For Families

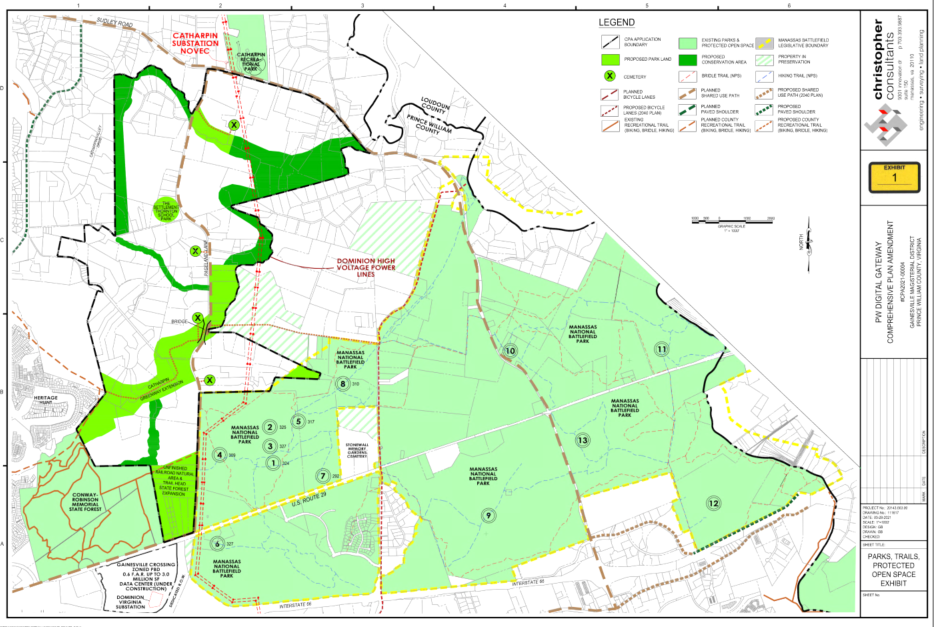

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Manassas City Council Votes To Decrease Personal Property Tax Bills Prince William Living

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

Real Property Management Pros Prince William County Home Facebook Haymarket Va

Data Center Opportunity Zone Presented By Prince William County Va Department Of Economic Development Date May 20 Ppt Download

Prince William County A Case Study

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Dhr Virginia Department Of Historic Resources 076 5080 Prince William County Courthouse

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

The Rural Area In Prince William County

Job Opportunities Prince William County

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Rural Crescent In Prince William County

Virginia To Issue 3 2 Million Tax Rebates Starting This Week

Listen To The People And Vote No To Prince William Digital Gateway Bristow Beat